Key Insights:

- XRP experiences a surge in price and address activity, indicating growing interest among cryptocurrency enthusiasts.

- Despite a recent decline, XRP’s market capitalization and trading volume show cautious investor behavior.

- Technical indicators suggest a bearish trend, but long-term potential is highlighted by increasing address activity.

The remarkable increase in price and address activity within the XRP Network has captured the interest of numerous cryptocurrency enthusiasts. Positioned as the sixth-ranking asset in market capitalization, XRP is a prominent player in digital currencies. Over the past 19 days, its value has experienced a significant surge of 22%, demonstrating the escalating fascination surrounding this particular asset. The surge in address activity, reaching historically high levels, provides further evidence of XRP’s growing popularity among investors.

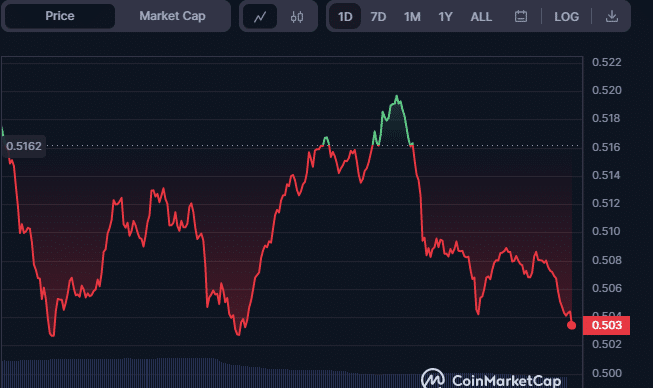

Nonetheless, within the preceding 24-hour period, there was a significant decline in the XRP market, and all endeavors to rebound proved futile due to encountering a formidable resistance level at $0.5197 as the intraday peak. The bears adeptly diminished the value of XRP, leading it to slide from its pinnacle to reach an intraday low of $0.5025, where it discovered a support level. As of now, bearish market conditions persist, resulting in a 0.19% decrease in the price of XRP, settling at $0.5052 from its previous closing value.

CypherMindHQ.com Artificial Intelligence Crypto Trading System - Surpass the competition with this cutting-edge AI system! Utilize the prowess of innovative algorithms and amplify your crypto trading strategies with CypherMindHQ. Learn more today!

The market capitalization of XRP witnessed a decline of 1.91%, amounting to $26,288,693,979, whereas the 24-hour trading volume experienced a significant decrease of 33.50% totaling $1,450,254,763. This downturn can be attributed to the cautiousness and hesitation of investors who closely monitor the market and delay making substantial investments until signs of recovery become evident.

XRP/USD 24-hour price chart (Source: CoinMarketCap)

The MACD blue line is below the signal line and in the negative zone at -0.0021 on the XRP market’s 2-hour price chart. Since this action suggests a bearish trend in the market, investors may want to consider selling their XRP tokens or waiting till the price may decline before repurchasing them.

The stochastic RSI for XRP on the 2-hour time frame is now at 0.48, and the stock price has just dropped below the signal line, indicating that the stock may be oversold and due for a temporary upswing. Traders should proceed cautiously, as this upswing might be a relief rally rather than a change in the underlying trend.

XRP/USD 2-hour price chart (Source: TradingView)

On the XRP price chart, the top and bottom bars of the Keltner Channel bands have values of 0.5244 and 0.4926, respectively. This pattern indicates that the price of XRP may continue to fall and will shortly challenge the lower support level.

This viewpoint is supported by the price action movement, which creates red candlesticks towards the bottom band. If the price movement continues in this manner and breaches the lower band, indicating that the market is oversold, a reversal or rebound is possible.

The Chaikin Money Flow (CMF) value of 0.13 on the XRP price chart suggests more selling pressure than purchasing demand. This level indicates that investors are selling XRP more than they are purchasing it, which might lead to more price decreases if the trend continues.

CypherMindHQ.com Artificial Intelligence Crypto Trading System - Outpace the competition with this high-end AI system! Leverage the capabilities of progressive algorithms and enhance your crypto trading performance with CypherMindHQ. Learn more today!

XRP/USD 2-hour price chart (Source: TradingView)

Conclusion

In conclusion, XRP faces short-term challenges as bears dominate the market, but the growing address activity and investor interest highlight its long-term potential.