Key Insights:

- The LTC market is currently experiencing bullish momentum, but indicators suggest a potential correction on the horizon.

- The surge in market activity for Litecoin is partly due to the recent inclusion of BRC-20 tokens into its LTC-20 network.

- Overbought conditions and an increase in bearish buying pressure indicate a correction or consolidation period may be forthcoming for Litecoin.

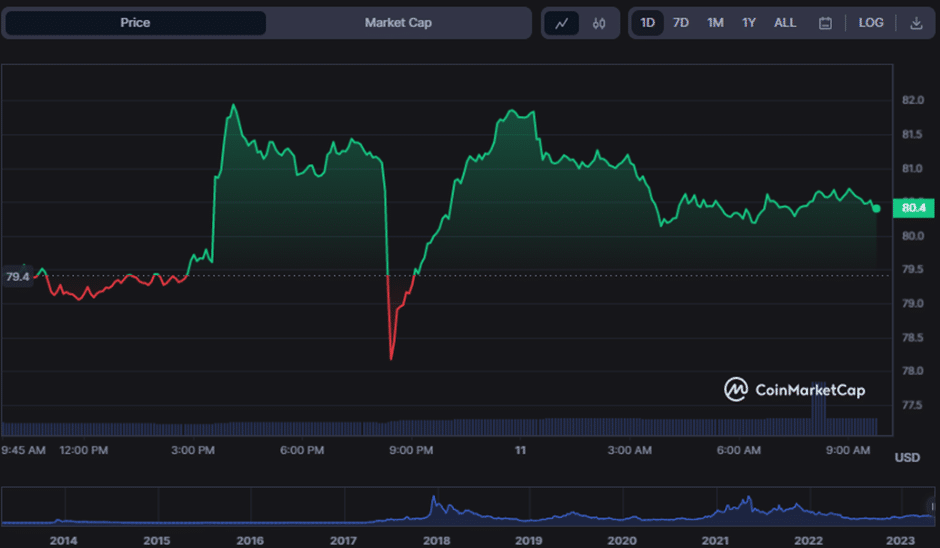

Litecoin (LTC) kicked off the day with a 24-hour low of $78.18, but the bears quickly lost their grip as the bulls took charge, propelling the price up to $81.97 before encountering resistance. Currently, the cryptocurrency is valued at $80.18, indicating a 1.30% increase in favourable market momentum.

The current market trends indicate a potential bull rally, leading to a rise in market capitalization by 1.35% and a staggering increase of 31.60% in the 24-hour trading volume to $5,872,692,063 and $594,060,510, respectively, as traders eagerly await a potential surge in cryptocurrency prices.

CypherMindHQ.com Artificial Intelligence Crypto Trading System - Surpass the competition with this cutting-edge AI system! Utilize the prowess of innovative algorithms and amplify your crypto trading strategies with CypherMindHQ. Learn more today!

Litecoin’s market activity surge can be linked to the recent inclusion of BRC-20 tokens into its LTC-20 network, creating more than 840 tokens. As a consequence, there may be an increase in daily transactions and active addresses on the Litecoin network.

LTC/USD 24-hour price chart (source: CoinMarketCap)

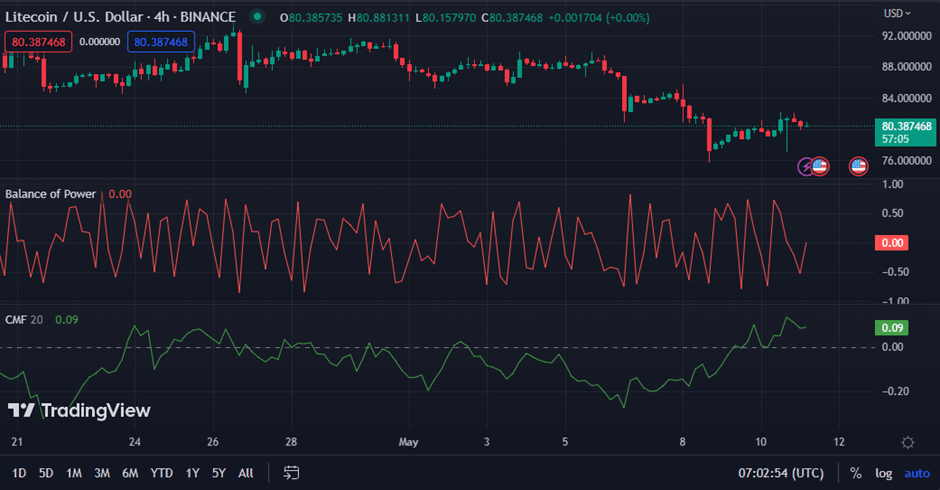

The Balance of Power (BOP) value for the LTC market is now -0.06 and is growing, indicating a likely move toward positive momentum in the market. As the BOP approaches zero and enters positive territory, purchase pressure is growing, which might lead to a price rise for Litecoin.

Increasing levels of buying pressure in the long-term care market are indicated by a Chaikin Money Flow indicator of 0.09 or higher that is trending upward.

A buying pressure that is more than the selling pressure might result in a rise in the price of Litecoin, which would support the continuation of the bull trend. A CMF number that is positive shows that there is more buying pressure than there is selling pressure.

LTC/USD chart (source: TradingView)

The stochastic relative strength index (RSI) is overbought and below its signal line at 86.30. This indicates that the upward momentum in the LTC market may be coming to an end.

This overbought rating suggests that the recent price increase in Litecoin was too rapid and unsustainable and that a correction is likely to occur soon.

CypherMindHQ.com Artificial Intelligence Crypto Trading System - Outpace the competition with this high-end AI system! Leverage the capabilities of progressive algorithms and enhance your crypto trading performance with CypherMindHQ. Learn more today!

The Bull Bear Power (BBP) indicator contributes to the notion that the bullish momentum seen in the LTC market is beginning to wane. The Bearish Buying Pressure (BBP) indicator now stands at -0.020625, which indicates that sellers are gaining some ground in the market. As a result, the price of Litecoin may be overdue for a correction or period of consolidation.

LTC/USD chart (source: TradingView)

Conclusion

To summarize, despite the substantial growth in the LTC market, various signals imply that an imminent correction could be looming. Traders must remain vigilant and stay abreast of market updates to manage any possible instability effectively.