Key Insights:

- SUI market sentiment turned bearish, causing a significant 11.18% price drop.

- Traders should wait for an apparent reversal before entering an extended position in the SUI market.

- Despite selling pressure, there is still some purchase pressure in the market, indicating a potential buying opportunity.

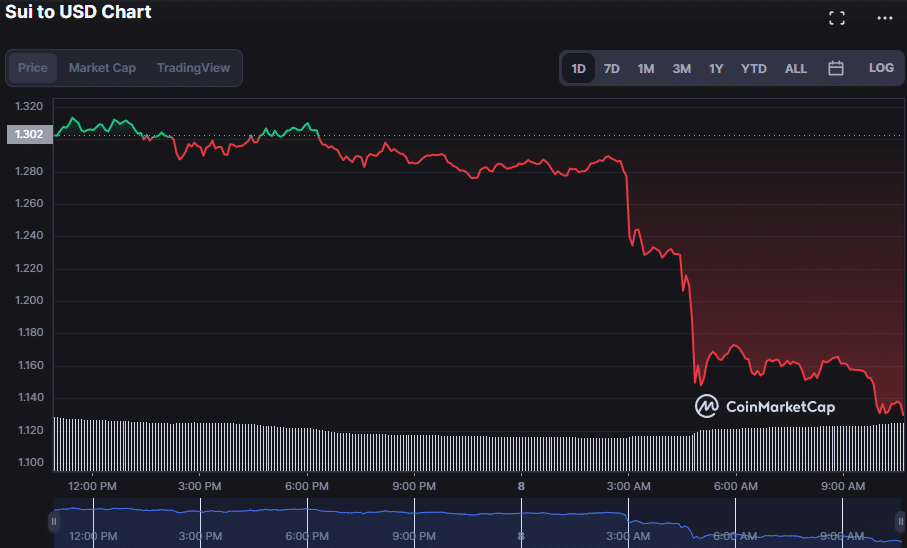

Earlier today, bulls in the SUI market were initially successful in pushing the price up, but their progress was hindered by significant resistance at the $1.31 level. As a result, the market sentiment turned bearish, causing the price to drop to a 24-hour low of $1.1538 as of the time of writing, representing a substantial 11.18% decrease.

If the bears break the critical support level of $1.13, the next level of interest would be $1.00. This sudden price drop could be attributed to profit-taking by investors who had bought SUI at a lower price and are now liquidating their positions.

CypherMindHQ.com Artificial Intelligence Crypto Trading System - Surpass the competition with this cutting-edge AI system! Utilize the prowess of innovative algorithms and amplify your crypto trading strategies with CypherMindHQ. Learn more today!

The downturn significantly impacted SUI’s market capitalization and 24-hour trading volume, dropping by 13.49% and 6.60%, respectively, to $597,521,649 and $373,553,888. The decline suggests investors may exercise caution and sell off their SUI holdings.

SUI/USD 24-hour price chart (source: CoinMarketCap)

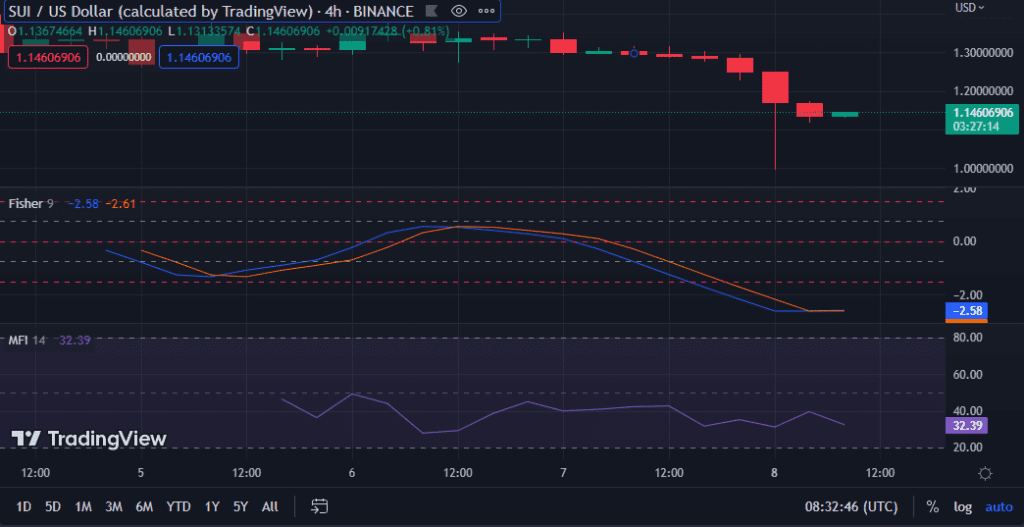

The Fisher Transform movement, with a value of -2.61, shows that the price of SUI/USD is likely to continue its downward trend, marking a potential selling opportunity for traders.

Because of this trend, traders may choose to sell or wait for an apparent reversal before entering an extended position.

The downward trend in SUI may continue, with a Money Flow Index rating of 32.45. A rating of less than 50 indicates that selling pressure may outnumber purchase demand, resulting in more price declines, hence the pessimistic expectation.

SUI/USD chart (source: TradingView)

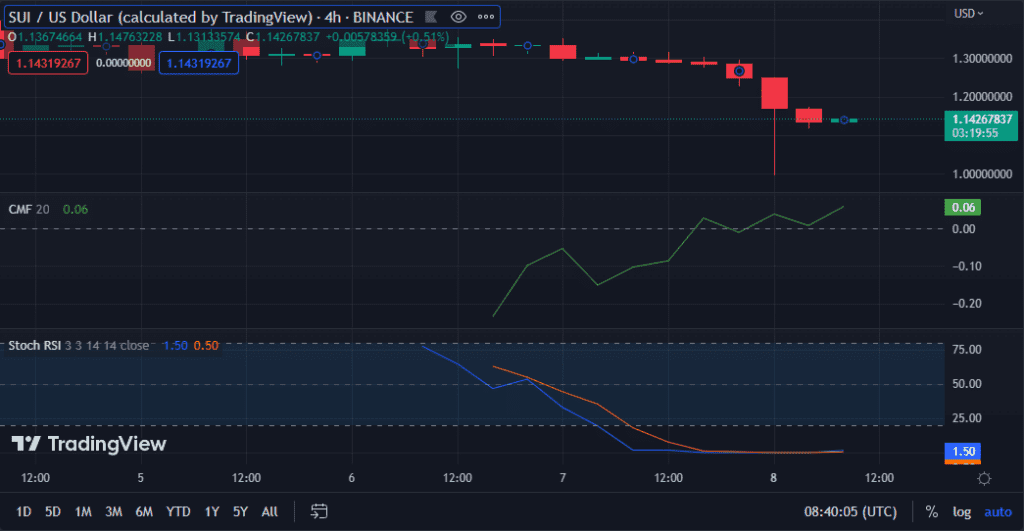

Despite the fact that the SUI market is adverse, the Chaikin Money Flow (CMF) pointing upwards in a favorable region with a value of 0.06 indicates that there is still some purchase pressure in the market.

This means traders should wait for an apparent trend reversal before considering a purchase opportunity since the current bullish activity might be a market correction.

CypherMindHQ.com Artificial Intelligence Crypto Trading System - Outpace the competition with this high-end AI system! Leverage the capabilities of progressive algorithms and enhance your crypto trading performance with CypherMindHQ. Learn more today!

The Stochastic RSI value of 1.50 on the SUI/USD price chart indicates that the market is oversold, with high selling and minimal buying pressure. Although the negative momentum will continue, a trend reversal is likely if the Stochastic RSI climbs above the oversold level of 20.

SUI/USD chart (source: TradingView)

Conclusion

In conclusion, SUI is under selling pressure but may soon give a buying opportunity as signs indicate the market is oversold.