Key Insights:

- Cumberland’s $69 million ETH withdrawal signals a market shift, raising concerns of an impending downturn.

- Ethereum experiences bearish forces, with declining market capitalization and trading volume, leading to cautious investor behaviour.

- Bearish indicators on the price charts suggest potential further falls, urging traders to consider short positions and monitor market momentum.

Ethereum has witnessed Cumberland’s withdrawal of 37,600 ETH ($69 million), demonstrating its careful investment strategy. Cumberland’s recent actions, pulling Ethereum from leading exchanges like Binance and Coinbase, indicate a significant market shift. This strategic move suggests that Cumberland is anticipating an impending market downturn or actively seeking to diversify their investment portfolio.

Despite the underlying cause, the potential consequences of this retreat could significantly influence the general market perception surrounding Ethereum. Nevertheless, within the last 24 hours, the Ethereum market has fallen under the dominion of bearish forces, causing the price to plummet from an intraday peak of $1,867.23 to an intraday trough of $1,822.30. Currently, at the time of composing this text, ETH is being traded at $1,846.28, representing a 0.78% decline from its previous closing value.

CypherMindHQ.com Artificial Intelligence Crypto Trading System - Surpass the competition with this cutting-edge AI system! Utilize the prowess of innovative algorithms and amplify your crypto trading strategies with CypherMindHQ. Learn more today!

The decline in ETH’s market capitalization and 24-hour trading volume was observed, with a 2.01% decrease to $221,182,586,303 and a significant 22.81% drop to $7,195,259,742, respectively. The decline can be attributed to investors’ cautious approach and uncertainty, as they diligently observe the ETH market and delay substantial investments until a recovery is evident.

ETH/USD 24-hour price chart (Source: CoinMarketCap)

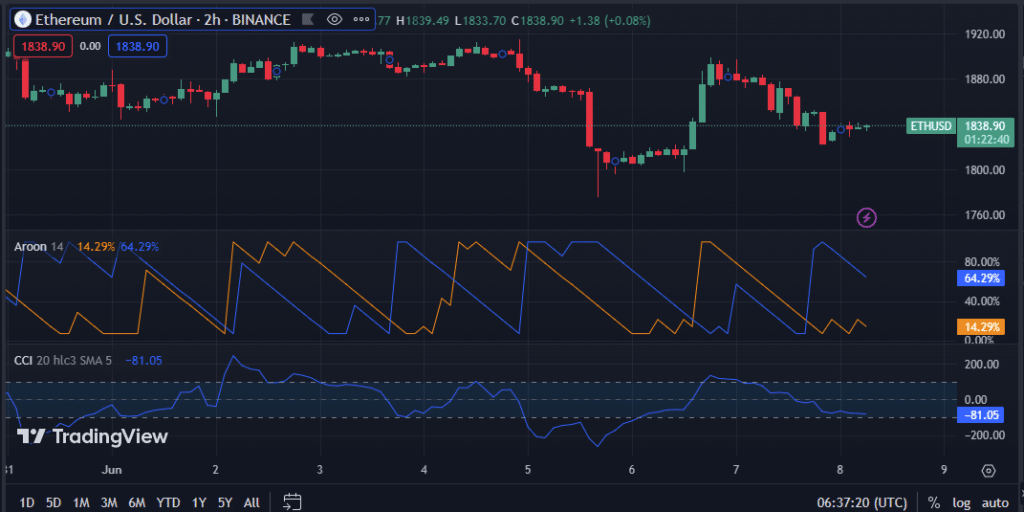

The Aroon up and down readings on the 2-hour price chart for the ETH market are 14.29% and 64.29%, respectively. This pattern signals that additional price falls may be on the horizon and indicates significant negative pressure. Traders should closely monitor these figures and consider initiating short bets or liquidating their current holdings.

The Commodity Channel Index (CCI), which has a line heading south and a value of -80.52 on the 2-hour price chart, is in negative territory and indicates that the market might be oversold. Because this signals that the market is headed in a bearish direction, traders should be careful when taking long bets.

ETH/USD 2-hour price chart (Source TradingView)

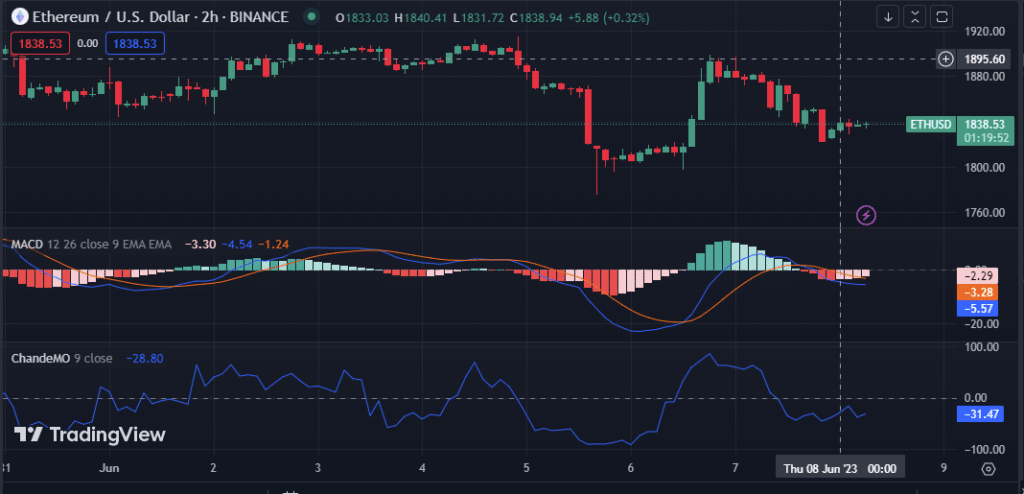

The 2-hour price chart’s MACD blue line, which has a value of -5.58 and is pointed southern, is located beneath its signal line and shows a downward trend in the price of ETH. The market is in decline, investors should consider selling ETH or delaying additional investments until the trend changes.

With a score of -31.73, the Chande Momentum Oscillator (ChandeMo) for the ETH market is in negative territory. This action indicates that the market is currently in a negative trend and that further declines could occur more quickly. Traders and investors may view this as a tip to sell or postpone buying until the momentum shifts to a more bullish direction.

ETH/USD 2-hour price chart (Source TradingView)

CypherMindHQ.com Artificial Intelligence Crypto Trading System - Outpace the competition with this high-end AI system! Leverage the capabilities of progressive algorithms and enhance your crypto trading performance with CypherMindHQ. Learn more today!

Conclusion

The cautionary signs of a substantial withdrawal and bearish market indicators within ETH indicate a forthcoming decline. Traders and investors are advised to evaluate the circumstances diligently, contemplate taking short positions, and remain vigilant for any signs of a potential market rebound.